Business

Bank Customers Borrowed N947bn Amid Naira Scarcity

According to a document produced by the Monetary Policy Committee of the Central Bank of Nigeria, in December 2022, Deposit Money Banks provided their customers with 130,854 brand-new credits totaling N947.46 billion.

Adeola Adenikinju, a member of the MPC, made this clear in a personal statement he gave at the most recent committee meeting.

He also said that in 2022, the banking industry’s assets increased by N14.36 trillion and the industry’s credit increased by N5.14 trillion.

“All measures of industry aggregates:,” Adenikinju stated. Credit, deposits, and assets all went up year over year. Between December 2021 and December 2022, the banking industry’s total assets increased by N14.36 trillion. In a similar vein, industry credit rose by N5.14 trillion during the same time frame.

“In addition, between the end of December 2021 and 2022, total industry deposits increased by N7.08 trillion. A total of 130,854 new credits worth N947.46 billion were granted to various customers in December 2022.

The member of the MPC also disclosed that the maximum lending rate was raised from 28.14 percent to 29.13 percent.

Adenikinju continued, “Interest rate spread month-to-month widened to 23.42 percent in December 2022, as maximum lending rate increased from 28.14 percent to 29.13 percent and average savings rate rose from 3.93 percent to 4.13 percent respectively between November and December 2022.”

This took place during the CBN’s policy of redesigning the naira, which caused many Nigerians to run out of the currency.

There was approximately N2.57 trillion in currency outside of banks in December of last year.

According to the most recent information available on the Money and Credit Statistics section of the CBN’s website, the PUNCH discovered that this amount dropped to N788.92 billion in January 2023.

This decreased by 69.26 percent between December 2022 and January 2023, according to the available data.

Additionally, this meant that the CBN obtained N1.78 trillion from money outside of banks.

The data also show that the amount of currency in circulation in January 2023 will be N1.39 trillion, down from N3.01 trillion in December, a difference of N1.62 trillion, or 53.82%.

This occurred as a result of a severe shortage of old currency and new naira notes, which combined to cause untold suffering and hardship to millions of Nigerians and left a number of people stranded.According to a recent report from The PUNCH, the banking industry’s total assets increased by N14.36 trillion, or 24.24 percent, from N59.24 trillion at the end of December 2021 to N73.59 trillion during the same time period in 2022.

-

Sports4 days ago

Sports4 days agoFA Cup: Man Utd suffer fresh triple injury blow ahead Coventry clash

-

News6 days ago

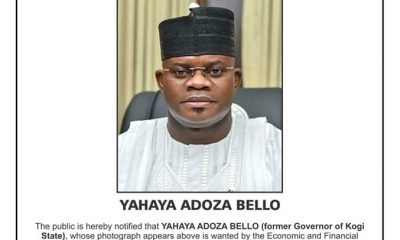

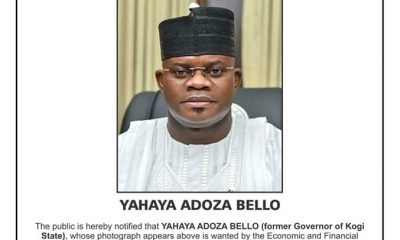

News6 days agoJUST-IN: EFCC declares Kogi ex-gov, Yahaya Bello wanted

-

News7 days ago

News7 days agoPort Harcourt company gifts plot of land to Law Graduate, Anyim Veronica

-

Politics6 days ago

Politics6 days agoBayelsa Assembly screens 13 commissioner nominees

-

Business3 days ago

Business3 days agoI met N13bn IGR per month but we are now seeing N27bn – Fubara

-

News4 days ago

News4 days agoDespite Apology, ABU Zaria Final-Year Law Student Arrested For Defaming Police Officer On Facebook

-

Politics4 days ago

Politics4 days agoSERAP To Govs, Wike: Account For Trillions Of FAAC Allocations

-

News2 days ago

News2 days agoCourt orders Becky Buodeigha alias Becky Minaj, CEO of BM Secrets to pay Baraza N7m