Business

Experts divided over interest rate hike ahead of MPC meeting

Ahead of the two-day Monetary Policy Committee meeting of the Central Bank of Nigeria commencing on Monday, financial experts have expressed uncertainties over possible interest rate hike.

As part of its event calendar for 2023, the CBN disclosed that it would hold its 289th meeting in Abuja.

Speaking on the prospective outcome of the MPC meeting, a professor of Capital Market and Chairman of Chartered Institute of Bankers of Nigeria, Abuja Branch, Prof Uche Uwaleke, explained that the Committee would likely keep all the monetary policy parameters.

He said, “Plethora of historical evidence suggests that the MPC rarely adjusts policy rates in January due to the need to allow the markets to stabilise in the New Year.

“Also, inflationary pressure is beginning to reduce, as seen in headline inflation numbers for December 2022.

“I do not advise a further hike in MPR, as doing so beyond the current high rate of 16.5 per cent can jeopardise economic growth.”

However, researchers at Cordros Securities expect a rate hike after the meeting.

In a report, the group of experts explained that MPC might toe the line of their global counterpart to introduce a small interest rate hike.

“Looking elsewhere, the prospect of global Central Banks embarking on smaller interest rate hikes could also influence the MPC’s decision to toe the same line amid concerns about the domestic economy”, they stated

-

News6 days ago

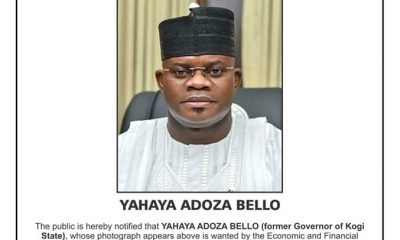

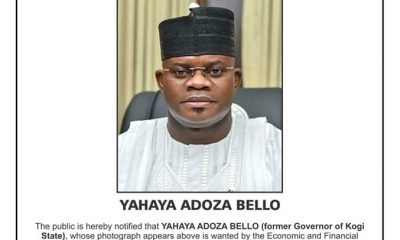

News6 days agoJUST-IN: EFCC declares Kogi ex-gov, Yahaya Bello wanted

-

Sports4 days ago

Sports4 days agoFA Cup: Man Utd suffer fresh triple injury blow ahead Coventry clash

-

News6 days ago

News6 days agoPort Harcourt company gifts plot of land to Law Graduate, Anyim Veronica

-

Politics6 days ago

Politics6 days agoBayelsa Assembly screens 13 commissioner nominees

-

Business3 days ago

Business3 days agoI met N13bn IGR per month but we are now seeing N27bn – Fubara

-

News4 days ago

News4 days agoDespite Apology, ABU Zaria Final-Year Law Student Arrested For Defaming Police Officer On Facebook

-

Politics7 days ago

Politics7 days agoRivers State Unity: Group Takes a Swipe at Abiye Sekibo over Plot to Destabilize it

-

Politics3 days ago

Politics3 days agoSERAP To Govs, Wike: Account For Trillions Of FAAC Allocations