Business

First Bank investors lose N53.84bn to Otedola, Hassan-Odukale leadership tussl

It seems First Bank’s attempt to douse the chaos around the lender in the capital market failed to sway investors confidence following the leadership tussle between Femi Otedola and Tunde Hassan-Odukale.

The company, in a swift fashion, released a statement ranking Hassan-Odukale as its majority stakeholder, shortly after announcing Otedola as its major shareholder – handing the control of First Bank to the Leadway Assurance boss.

Tracknews Online analysis shows the clarification didn’t stop investors’ total investment in First Bank from crashing by 11.95 percent in a space of five days, as prospectives priced the lender’s stock low, following minority shareholders sell off amid uncertainty surrounding ownership structure.

Otedola‘s short-lived position as the majority shareholder had swung investors confidence in favour of the lender, resulting to over 50 percent increase in investment value in the first two weeks of October.

But this gain was almost erased by the misinformation emitting from First Bank’s management in the last two weeks of same months – a case of First Bank shooting itself in the foot.

The 11.95 percent decline in market value resulted from depreciation of stock value which dropped to N11.05 per share on Friday, from Monday’s N12.55kobo, as some shareholders took out their investment in First Bank.

The sell off caused investors to lose N53.84 billion in five days, after the exit forced First Bank’s market cap to dwindle to N396.64 billion at the end of trading on Friday, against Monday’s N450.48 billion.

-

News5 days ago

News5 days agoAttack on nurse: Enugu Assembly moves to regulate activities of masquerades

-

News2 days ago

News2 days agoFake Reverend Sister Arrested With 38 Children

-

Politics6 days ago

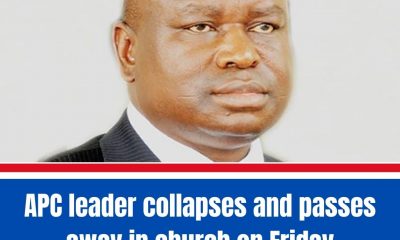

Politics6 days agoAPC leader collapses and passes away in church on Friday

-

News6 days ago

News6 days agoLocal Content, Local Fraud

-

News6 days ago

News6 days agoCourt awards N10m damages against EFCC for ‘unlawful’ publication against Christ Embassy Pastor Miebi Bribena and wife

-

Politics7 days ago

Politics7 days agoHon. Dr Gentle Emelah inaugurated as commissioner of education,

-

Gist15 hours ago

Gist15 hours agoMy Boss Used To ‘KNACK’ My Wife After Sending Me On A Mission, To The Extent She Got… – Ex-soldier

-

Politics5 days ago

Politics5 days agoMagnus Abe: my rift with Wike over