Business

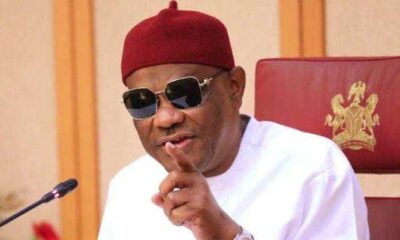

Rivers got N4.7bn from N15.1bn VAT, Kano got N2.8bn it generated, Wike

Governor of Rivers State, Nyesom Wike on Wednesday met with corporate bodies and other stakeholders affected by the recent Value Added Tax (VAT) Law enacted by the state to inform them of the commencement of its implementation.

He told them that it was necessary to state the position of the law to the business community in the state.

Such understanding, he argued, would enable them not to fall prey to the antics that could be deployed by the Federal Inland Revenue Service (FIRS) officials who, he said, think they can use force to collect what does not belong to them.

The governor explained that the FIRS had in the past collected VAT in the state with impunity, knowing it was unconstitutional for them to do so.

According to him, his administration challenged their impunity in court and the Federal High Court in Port Harcourt in its declarative ruling had stated the constitution is right in vesting powers to collect VAT in the state government within its jurisdiction.

“When we challenged the Federal Government through the Office of the Attorney-General and FIRS in court, do you know what they did? They wrote this letter dated 1st of July 2021. Remember, it was in 2020 that we filed this action against them. But see how corrupt this country is.

Corruption is not only about kickbacks, it is also about doing something illegally. We were in court in 2020. Then on July 1st 2021, the chairman of FIRS wrote to the National Assembly through the office of the Deputy Speaker of the House of Representatives.

“He was asking them to amend the constitution and insert VAT under item 58 of the exclusive legislative list, when we were already challenging that it is not their responsibility to collect VAT. They knew that what they were doing was not the right thing.”

He stated that his responsibility in office included making sure that Rivers people are not denied their entitlements and described as unfortunate FIRS resorted to writing threatening letters to intimidate corporate organisation to pay to them even after they have lost their appeal that sought a stay of execution of the declarative ruling on VAT collection in the state.

Wike urged the business community to be ready to pay VAT for the month of September 2021 and subsequent months to the Rivers State Internal Revenue Service as according to him, he has already assented to the Rivers State VAT law passed by the State House of Assembly.

He warned corporate organisations not to feign ignorance of the State VAT law declaring that the State government will not hesitate to seal up the premises of any company that defaults.

“We are going to inaugurate the Tax Appeal Commission by Friday which will be headed by a retired judge of the state.”

The governor described the disparity in VAT proceeds and what is given to the states as an inexplicable form of injustice that weakens the performance potential of the states.

Let me tell you the injustice in this country. In the month of June 2021, which we shared in July, VAT collected in Rivers State was N15.1billion. What they gave us was N4.7billion. See the gross injustice and this money includes contracts awarded by the Rivers State Government.

“This is not an issue of party, it is the issues of infraction of the constitution, issues of illegality. Look at Lagos, it is not the same party as me. In the month of June 2021, the VAT collected in Lagos was N46.4 billion but see what Lagos got, N9.3 billion! Have you seen the injustice in the country? VAT collected in Kano was N2. 8 billion and they gave them N2.8 billion. Is there any justice in this country?”

-

News4 days ago

News4 days agoAttack on nurse: Enugu Assembly moves to regulate activities of masquerades

-

Business7 days ago

Business7 days agoWhy CBN Banned Opay, Palmpay, Kuda Bank, Moniepoint From Boarding New Customers

-

Politics6 days ago

Politics6 days agoSouth-South Govs Meet In Yenagoa, Urge FG To Review Power Situation

-

Niger Delta7 days ago

Niger Delta7 days agoRE: PROTEST AGAINST PAP BOSS DR DENNIS OTUARU, AN UNNECESSARY DISTRACTION THAT SHOULD NOT BE TAKEN SERIOUSLY.

-

Politics7 days ago

Politics7 days agoFormer IYC Scribe Congratulates Hon. Maxwell Ebibai on Reappointment as Bayelsa Commissioner for Finance.

-

Politics7 days ago

Politics7 days agoHon. Alapala Felicitates with Commissioners for successful inauguration and thank the governor for their appointments.

-

News5 days ago

News5 days agoLocal Content, Local Fraud

-

Politics4 days ago

Politics4 days agoAPC leader collapses and passes away in church on Friday