Business

World Bank: Global growth to slow to 2.1% in 2023

A new World Bank report has said global growth has slowed sharply and the risk of financial stress in developing economies is intensifying amid high global interest rates.

According to the latest Global Economic Prospects report released on Tuesday in Washington DC, Sub-Saharan Africa’s growth will reduce to 3.2% in 2023 and rise to 3.9% in 2024.

It identified the factors responsible for the slowdown including the pandemic, the Russian invasion of Ukraine, and the sharp slowdown amid tight global financial conditions.

World Bank Group President Ajay Banga said: “The surest way to reduce poverty and spread prosperity is through employment—and slower growth makes job creation a lot harder. It’s important to keep in mind that growth forecasts are not destiny. We have an opportunity to turn the tide but it will take us all working together.”

The World Bank Group’s Chief Economist and Senior Vice President, Indermit Gill, said the world economy is in a precarious position.

“Outside of East and South Asia, it is a long way from the dynamism needed to eliminate poverty, counter climate change, and replenish human capital. In 2023, trade will grow at less than a third of its pace in the years before the pandemic. In emerging markets and developing economies, debt pressures are growing due to higher interest rates. Fiscal weaknesses have already tipped many low-income countries into debt distress. Meanwhile, the financing needs to achieve the sustainable development goals are far greater than even the most optimistic projections of private investment,” Gill said.

In low-income countries, the report said, per capita incomes in 2024 will still be below 2019 levels and will entrench extreme poverty.

“Many developing economies are struggling to cope with weak growth, persistently high inflation, and record debt levels. Yet new hazards—such as the possibility of more widespread spillovers from renewed financial stress in advanced economies—could make matters even worse for them,” said Ayhan Kose, Deputy Chief Economist of the World Bank Group. “Policymakers in these economies should act promptly to prevent financial contagion and reduce near-term domestic vulnerabilities.”

A statement on the report said growth in advanced economies will decrease from 2.6% in 2022 to 0.7% this year and remain weak in 2024.

“After growing 1.1% in 2023, the U.S. economy is set to decelerate to 0.8% in 2024, mainly because of the lingering impact of the sharp rise in interest rates over the past year and a half. In the euro area, growth is forecast to slow to 0.4% in 2023 from 3.5% in 2022, due to the lagged effect of monetary policy tightening and energy-price increases.

“The report also offers an analysis of how increases in U.S. interest rates are affecting EMDEs. Most of the rise in two-year Treasury yields over the past year and a half has been driven by investor expectations of hawkish U.S. monetary policy to control inflation. According to the report, this particular type of interest rate increase is associated with adverse financial effects in EMDEs, including a higher probability of a financial crisis. Moreover, these effects are more pronounced in countries with greater economic vulnerabilities. In particular, frontier markets—those with less developed financial markets and more limited access to international capital—tend to see outsized increases in borrowing costs; for instance, sovereign risk spreads in frontier markets tend to rise by more than three times as much as those in other EMDEs,” the statement said.

The report said rising interest rates have compounded the deterioration in the fiscal positions of developing nations.

-

Sports4 days ago

Sports4 days agoFA Cup: Man Utd suffer fresh triple injury blow ahead Coventry clash

-

News7 days ago

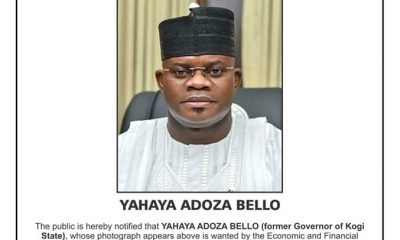

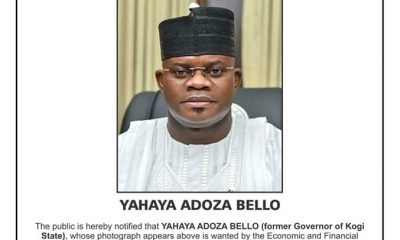

News7 days agoJUST-IN: EFCC declares Kogi ex-gov, Yahaya Bello wanted

-

News7 days ago

News7 days agoPort Harcourt company gifts plot of land to Law Graduate, Anyim Veronica

-

Politics7 days ago

Politics7 days agoBayelsa Assembly screens 13 commissioner nominees

-

Business4 days ago

Business4 days agoI met N13bn IGR per month but we are now seeing N27bn – Fubara

-

News4 days ago

News4 days agoDespite Apology, ABU Zaria Final-Year Law Student Arrested For Defaming Police Officer On Facebook

-

Politics4 days ago

Politics4 days agoSERAP To Govs, Wike: Account For Trillions Of FAAC Allocations

-

News2 days ago

News2 days agoCourt orders Becky Buodeigha alias Becky Minaj, CEO of BM Secrets to pay Baraza N7m