America’s Mastercard and Togo’s Ecobank Group yesterday announced a new partnership to connect millions of smallholder farmers in Sub-Saharan Africa to Mastercard’s Farm Pass – a digital platform that makes it safer and easier for farmers to sell their produce at a fair price.

Under the partnership, Ecobank will extend the reach and impact of the Mastercard Farm Pass platform leveraging its Pan-African network of 33 countries. Many smallholder farmers in Sub-Saharan Africa face several challenges.

These include limited access to markets, working capital to finance activities or secure quality inputs, and relevant financial tools to pay and get paid efficiently. This has led to insecurity, inefficiencies, and a waste of resources and food, preventing farmers from running sustainable businesses.

Farm Pass brings together various agri-sector stakeholders from the supply and demand sides, in one agricultural marketplace, amplifying the collective positive impact on farming communities. Smallholder farmers can sell their produce at a better price, access quality inputs and farming information, get paid and pay digitally and develop a financial profile that can unlock financing opportunities for working capital and inputs.

According to McKinsey and Company, more than 60% of the population of Sub-Saharan Africa are smallholder farmers, with the agricultural sector contributing an estimated 23% of the continent’s GDP. Yet only 3% of the sector receives banking credit, limiting the farmer’s capacity to grow their business or mitigate poor harvest losses.

By integrating their businesses with payment systems, Mastercard and Ecobank hope that Farm Pass enables smallholder farmers to build a digital transaction record that can facilitate formal credit or other financial services from banks and other financial institutions.

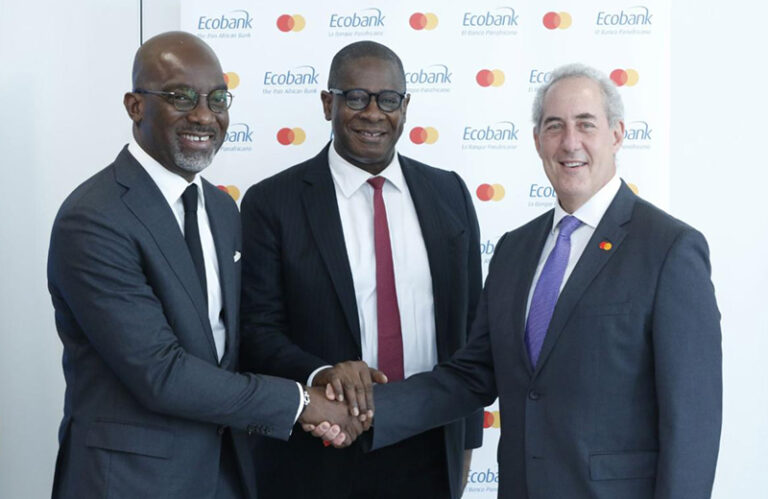

“Food security is a critical and urgent need in these times. We must therefore rise to the task by creating growth opportunities across the agriculture value chain in Africa. Our partnership with Mastercard has come at the right time to accelerate smallholder farmers’ access to urgently needed financial services, which are vital to realising Africa’s full agricultural potential,” says Ade Ayeyemi, CEO of Ecobank Group.

“It will also help deliver value across the farming and agricultural value chain to make farming in Africa more profitable, competitive, and resilient, thus contributing to the economic growth of the continent,” Ayeyemi adds.

“When we empower people, we can power economies and support economic growth that is truly inclusive. Mastercard Farm Pass contributes to this by offering a digital platform that makes it easier for smallholder farmers to move from subsistence to commercial farming. This, in turn, will stimulate agricultural growth, increase competitiveness, and improve food security in Africa. Through close collaborations with important partners like Ecobank, we can create even more impact, putting the digital economy to work for everyone, everywhere,” says Michael Froman, Vice Chairman and President, Strategic Growth at Mastercard.

According to Ecobank, since its launch in 2015, Mastercard Farm Pass has reached nearly one million smallholder farmers in Uganda, Tanzania, Kenya, and India, enabling them to command 25%-50% higher prices and increase harvest productivity.

Farm Pass is part of Mastercard’s strategy to connect underserved communities to essential services through Community Pass, a shared interoperable digital platform that supports the company’s commitment to connect one billion people and 50 million small and micro businesses to the digital economy by 2025.