News

CBN Directs Commercial Banks to Accept, Pay Out Old N500, N1,000 Notes

The Central Bank of Nigeria (CBN), yesterday, directed commercial banks and other financial institutions in the country to continue to accept and pay out the old N200, N500, and N1,000 notes till December 31, 2023, in line with a recent Supreme Court ruling.

In a statement signed by CBN’s Acting Director, Corporate Communications, Dr. Isa Abdulmumin, the central bank disclosed that it had met with the Bankers’ Committee and directed that the old banknotes remained legal tender alongside the redesigned notes.

But in apparent reaction to public unease over the federal government’s long silence and delayed response to the March 3 Supreme Court ruling on the currency redesign, the presidency yesterday said the CBN did not need a further directive from President Muhammadu Buhari to comply with the apex court’s order. The presidency said this in a statement by presidential spokesperson, Mallam Garba Shehu.

Relatedly, the Nigeria Labour Congress (NLC), yesterday, gave the federal government one-week ultimatum to resolve the present scarcity of both the naira and petrol, which had caused untold hardship to the masses, or face a nationwide workers strike.

In another development, CBN Governor, Mr. Godwin Emefiele, described as fake news a report that he had launched a fresh plot against the president-elect, Bola Tinubu.

The CBN stated, “In compliance with the established tradition of obedience to court orders and sustenance of the rule of law principle that characterised the government of President Muhammadu Buhari, and by extension, the operations of the CBN, as a regulator, deposit money banks operating in Nigeria have been directed to comply with the Supreme Court ruling of March 3, 2023.

“Accordingly, the CBN met with the Bankers’ Committee and has directed that the old N200, N500 and N1000 banknotes remain legal tender alongside the redesigned banknotes till December 31, 2023. Consequently, all concerned are directed to conform accordingly.”

Earlier yesterday, Buhari washed his hands of the reported refusal of the federal government to comply with the ruling of the Supreme Court extending the validity of the old banknotes to December 31, 2023. The presidency said the CBN did not require a presidential directive to comply.

The presidency, in a statement issued by presidential spokesperson, Shehu, stated that at no time did Buhari direct the Attorney General of the Federation (AGF) and the CBN not to comply with the apex court’s order on the on-going currency swap.

Shehu said Buhari, in the close to eight years of his administration, had never done anything to delay or obstruct the course of justice, but would rather continue to respect the judicial process and authority of the courts.

The statement said, “The Presidency wishes to react to some public concerns that President Muhammadu Buhari did not react to the Supreme Court judgement on the issue of the N500 and N1,000 old currency notes, and states here plainly and clearly that at no time did he instruct the Attorney General and the CBN governor to disobey any court orders involving the government and other parties.

“Since the president was sworn into office in 2015, he has never directed anybody to defy court orders, in the strong belief that we can’t practise democracy without the rule of law and the commitment of his administration to this principle has not changed.

“Following the on-going intense debate about the compliance concerning the legality of the old currency notes, the presidency, therefore, wishes to state clearly that President Buhari has not done anything knowingly and deliberately to interfere with or obstruct the administration of justice.

“The president is not a micromanager and will not, therefore, stop the Attorney General and the CBN governor from performing the details of their duties in accordance with the law. In any case, it is debatable at this time if there is proof of wilful denial by the two of them on the orders of the apex court.

“The directive of the president, following the meeting of the Council of State, is that the bank must make available for circulation all the money that is needed and nothing has happened to change the position.

“It is an established fact that the president is an absolute respecter of judicial process and the authority of the courts. He has done nothing in the last eight or so years to act in any way to obstruct the administration of justice, cause lack of confidence in the administration of justice, or otherwise interfere or corrupt the courts and there is no reason whatsoever that he should do so now when he is getting ready to leave office.”

Furthermore, the president’s spokesman noted that the negative campaign and personalised attacks against the president by the opposition and all manner of commentators were unfair and unjust, as no court order at any level had been issued or directed at him.

The statement said further, “As for the cashless system the CBN is determined to put in place, it is a known fact that many of the country’s citizens who bear the brunt of the sufferings, surprisingly support the policy, as they believe that the action would cut corruption, fight terrorism, build an environment of honesty and reinforce the incorruptible leadership of the president.

“It is, therefore, wide off the mark to blame the president for the current controversy over the cash scarcity, despite the Supreme Court judgement. The CBN has no reason not to comply with court orders on the excuse of waiting for directives from the president.”

Buhari also rejected the impression that he lacked compassion, saying, “No government in our recent history has introduced policies to help economically marginalised and vulnerable groups like the present administration.”

Collect Old Notes or Be Shut Down, Sanwo-Olu, Soludo Tell Banks

Meanwhile, to try to ameliorate the suffering engendered by the federal government’s sloppy implementation of the currency redesign, the governors of Lagos State, Mr. Babajide Sanwo-Olu, and Anambra State, Professor Chukwuma Soludo, yesterday, directed residents of their respective states to continue transactions with the old naira notes.

Sanwo-Olu gave the directive in a letter he wrote and addressed to Lagosians yesterday.

The governor said his directive on collection of the old naira notes was based on the Supreme Court verdict, which extended the validity of the notes to December 31, 2023, and the Bankers Committee’s directive to the commercial banks during its meeting on Sunday, March 12, 2023.

Sanwo-Olu expressed displeasure at the difficulties and pain Lagosians currently faced due to the naira redesign. He said the Lagos State government would sanction any business that failed to collect the old notes, warning that any bank branch that refuses to collect the notes would be shut down immediately and reported to the CBN.

The governor told Lagos residents to lodge complaints against any bank that refused to accept deposits of old notes to the Lagos State Consumer Protection Agency (LASCOPA).

The statement read, “My dear Lagosians, I have noted the difficulties you have been having over the naira redesign crisis. I feel your pain.

“I discussed with top officials in CBN who assured me that commercial banks were directed to accept the old N500 and N1,000 notes as deposits and pay them out for withdrawals.

“They informed me that commercial banks got the directive at a Bankers Committee meeting on Sunday, March 12, 2023.

“I, therefore, urge you to go ahead and have transactions with the old notes. Lagosians should feel free to use the old notes for commercial purposes. Retailers, transporters, traders and all businesses must not reject them, as they remain legal tender, following the Supreme Court verdict, which extends the validity of the notes to December 31, 2023.”

Sanwo-Olu warned, “Any business that fails to collect the notes will be heavily sanctioned. I, therefore, advise Lagos residents to freely accept and transact their businesses with the old currency notes (N200; N500; and N1,000) as well as the new notes.

“If any bank refuses to accept deposits of old notes, please, lodge a complaint with the Lagos State Consumer Protection Agency (LASCOPA) via these numbers; 08124993895, 09064323154, 08092509777.

“The Lagos State Government will report the bank to the CBN and immediately shut down the offending branch.

“I thank you so much and assure you that all this, too, shall pass, as the authorities are working to ensure that the teething problems of the redesigning of our currency are resolved.”

Soludo advised also residents of his state to freely accept and transact businesses with the old N200, N500 and N1,000 as well as the new notes.

In a statement he personally signed, which was obtained yesterday by TrackNews , Soludo disclosed that he spoke with the CBN governor on the matter by telephone and he confirmed that in compliance with the Supreme Court ruling, he had directed commercial banks to accept the old banknotes and also load their ATMs with the currencies.

The governor threatened to shut down any commercial bank that rejected the old N500 and N1,000 notes from depositors and refused to issue same to customers.

Soludo, a former CBN governor, added, “Commercial banks have been directed by the central bank to dispense old currency notes and to also receive same as deposits from customers.

“Tellers at the commercial banks are to generate the codes for deposits and there is no limit to the number of times an individual or company can make deposits.

“The governor of the CBN gave the directive at a Bankers’ Committee meeting held on Sunday, 12th March, 2023. The governor, Dr. Godwin Emefiele, personally confirmed the above to me during a phone conversation on Sunday night.

“Residents of Anambra are, therefore, advised to freely accept and transact their businesses with the old currency notes (N200, N500 and N1,000) as well as the new notes. Residents should report any bank that refuses to accept deposits of the old notes. Anambra State Government will not only report such a bank to the CBN, but will also immediately shut down the defaulting branch.”

Until the announcement by the governor, residents of Anambra had been complaining that banks issued to them old currency notes but would not accept the notes from depositors.

NLC Gives FG 7-Day Ultimatum to End Currency Scarcity

NLC gave the federal government one-week ultimatum to resolve issues causing prolonged scarcity of the naira as well as petrol. It warned that at the expiration of the ultimatum, the union might be forced to call out its members for a national strike.

Addressing journalists in Abuja on the decision of the Central Working Committee of the NLC, the president, Joe Ajaero, said the labour movement had observed with regret the suffering workers and Nigerians had been subjected to due to the cash squeeze resulting from government’s naira redesign policy. Ajaero said NLC had resolved to issue a seven-day ultimatum to the federal government to end the cash crunch or workers would stay away from duty nationwide.

Briefing newsmen on the position of labour, Ajaero said, “The congress wishes to inform the federal government that we will no longer keep quiet on this issue of perennial fuel scarcity and arbitrary increase of petroleum products prices.

“On the issue of cash crunch, the NLC is giving the federal government of Nigeria, the agencies of government, including the CBN and top banking institutions, seven working days to address the issue of the cash crunch.

“If they fail to do this at the expiration of the seven days, the Congress is directing all workers in the country to stay at home because it has become very difficult to even assess one naira to enter vehicles to your workplace.”

Ajaero said it had become very difficult to buy products, especially from traders who, in most cases, did not have bank accounts.

He stated, “This is the situation we have found ourselves. The federal government came out with the policy that even the old currencies are still valid. What we have discovered is that even when the banks give you those old currencies, the traders are not accepting it. And even when you take it to the same banks, the banks are not accepting it either. We are being frustrated to a level that we can no longer keep quiet.”

On the political situation in the country, NLC urged all gladiators to remember that the interest of the country was paramount and do everything reasonably possible to make sure that the system was maintained.

NLC also cautioned the judiciary to ensure that it did justice to the complaints of aggrieved politicians.

Emefiele Debunks Fake News, Denies Alleged Plot against Tinubu

CBN Governor, Mr. Godwin Emefiele, described as fake news a report that he had launched a fresh plot against the president-elect, Bola Tinubu.

Emefiele, in a statement signed by Abdulmumin, titled, “Re- Emefiele launches fresh plot against President-elect Tinubu,” and made available to THISDAY yesterday, also denied the allegation in the report that he made certain amounts of money available to the governorship candidate of Labour Party (lp) in Lagos State, Gbadebo Rhodes-Vivour.

The statement said, “The attention of the CBN has been drawn to a story published in The Nation newspaper of Monday, March 13, 2023 edition, alleging that the governor, Mr Godwin Emefiele, has launched a ‘fresh plot against President-elect’.

“The aforementioned story went further to allege that the governor has made certain amount of money available to a political aspirant ahead of March 18, 2023 gubernatorial poll.

“We wish to inform members of the public that this story is completely false and malicious, as the governor does not know and has never met or even spoken with Mr. Gbadebo Rhodes-Vivour either in person or through proxy.

“We wish to reiterate that the CBN governor does not take part in politics and, therefore, urge anyone with contrary information to prove the governor wrong should provide such facts.

“As such the governor and team at the CBN should be allowed to focus on their assigned job with a view to achieving statutory mandates of the Bank.”

-

News5 days ago

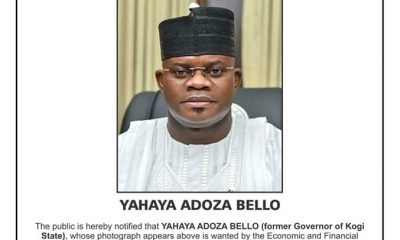

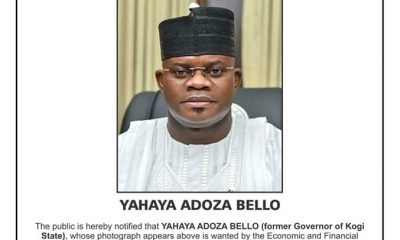

News5 days agoJUST-IN: EFCC declares Kogi ex-gov, Yahaya Bello wanted

-

Sports3 days ago

Sports3 days agoFA Cup: Man Utd suffer fresh triple injury blow ahead Coventry clash

-

News5 days ago

News5 days agoPort Harcourt company gifts plot of land to Law Graduate, Anyim Veronica

-

Politics5 days ago

Politics5 days agoBayelsa Assembly screens 13 commissioner nominees

-

Politics6 days ago

Politics6 days agoKogi State Governor, Usman Ododo, reportedly storms Yahaya Bello’s Abuja residence amidst EFCC siege.

-

Business2 days ago

Business2 days agoI met N13bn IGR per month but we are now seeing N27bn – Fubara

-

Politics2 days ago

Politics2 days agoSERAP To Govs, Wike: Account For Trillions Of FAAC Allocations

-

Politics6 days ago

Politics6 days agoRivers State Unity: Group Takes a Swipe at Abiye Sekibo over Plot to Destabilize it