National

NPF MFB raises N4.5b new capital

NPF Microfinance Bank Plc, a micro-lending financial institution promoted by the Nigeria Police Force (NPF), has successfully raised more than N4.5 billion in new equity capital, strengthening its position within the micro-banking subsector.

NPF MFB raised new equity capital from existing shareholders and new investors through a hybrid rights issue and public offer for subscription.

NPF MFB had simultaneously launched a rights issue to raise about N3.4 billion from existing shareholders and a public offer to raise N1.07 billion from the general investing public.

Application lists for the hybrid offer, which opened on June 24, 2021, was initially scheduled to close on June 30, 2021 but was extended to Friday, July 30, 2021.

The board of NPF MFB in a regulatory filing at the Nigerian Exchange (NGX) Limited confirmed that the hybrid rights and public offer was fully subscribed.

The microfinance bank had offered 2.29 billion ordinary shares of 50 kobo each to shareholders on the register of the bank as at the close of business on May 17, 2021 at a price of N1.50 per share. The shares were pre-allotted on the basis of one new ordinary share of 50 kobo each for every one ordinary share of 50 kobo each held.

It also offered, by way of public offer for subscription, 713.34 million ordinary shares of 50 kobo each at N1.50 per share to the general investing public.

The hybrid issue will automatically increase the paid up share capital of the bank by 131 per cent. The authorised capital of the bank at inception was N500, 000 made up of 500,000 ordinary shares of N1 each. This increased to the current level of N2 billion made up of 4.0 billion ordinary shares of 50 kobo each of which 2.29 billion ordinary shares of 50 kobo each are issued and fully paid up. NPF Microfinance was listed on the NSE on December 1, 2010.

Formerly NPF Community Bank, the bank was incorporated on May 19, 1993 as a limited liability company under the provision of the Companies and Allied Matter Act cap c20LFN 2004. It provides banking services to both serving and retired officers and men of Nigeria Police Force, its ancillary institution and general banking public. The bank commenced business on August 20, 1993.

-

News5 days ago

News5 days agoAttack on nurse: Enugu Assembly moves to regulate activities of masquerades

-

News2 days ago

News2 days agoFake Reverend Sister Arrested With 38 Children

-

Politics5 days ago

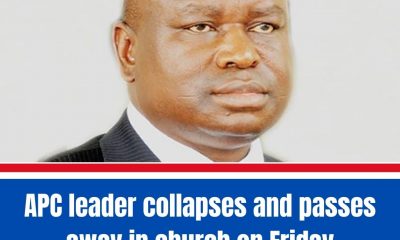

Politics5 days agoAPC leader collapses and passes away in church on Friday

-

News6 days ago

News6 days agoCourt awards N10m damages against EFCC for ‘unlawful’ publication against Christ Embassy Pastor Miebi Bribena and wife

-

News6 days ago

News6 days agoLocal Content, Local Fraud

-

Politics7 days ago

Politics7 days agoHon. Dr Gentle Emelah inaugurated as commissioner of education,

-

Politics5 days ago

Politics5 days agoMagnus Abe: my rift with Wike over

-

Gist10 hours ago

Gist10 hours agoMy Boss Used To ‘KNACK’ My Wife After Sending Me On A Mission, To The Extent She Got… – Ex-soldier