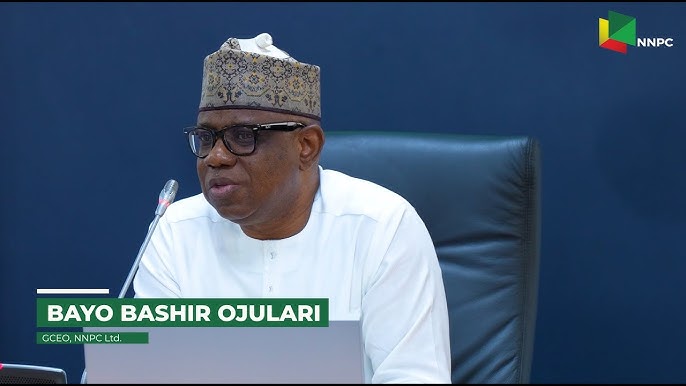

The Senate Committee on Public Accounts has issued a 10-day ultimatum to the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited (NNPCL), Bayo Ojulari, to respond to serious financial discrepancies in the company’s audited accounts.

The committee is demanding answers on ₦200 trillion in unexplained receivables and several other financial irregularities recorded between 2017 and 2023.

This directive was made public after a formal session held by the Senate Committee, which is chaired by Senator Aliyu Wadada. During the session, the committee expressed grave concerns over what it described as “astonishing and intolerable” inconsistencies in NNPCL’s financial records. The committee specifically cited the failure to account for vast sums, including unrecorded legal and audit fees, as among the 11 critical queries now facing the company.

The Senate’s action followed a formal request from NNPCL seeking an extension of two months to provide responses to the committee’s questions. That request, however, was immediately rejected. Senator Wadada stated clearly that the committee would not accept any delay tactics on matters involving public funds.

According to the committee, the deadline given to the NNPCL expires on July 10. Ojulari is expected to provide comprehensive explanations for all 11 financial queries by that date. Senator Wadada said failure to comply with the Senate’s mandate would be viewed as contempt of the legislature and could lead to constitutional consequences for the NNPCL leadership.

“It is unacceptable. We have given them 10 working days. This committee will not tolerate delay tactics in matters concerning public funds,” Wadada declared during the session. He added that the committee’s primary responsibility is to safeguard public resources and ensure financial accountability across all public institutions.

The committee stressed that it is empowered by the Nigerian Constitution to demand transparency and accountability from all agencies and government-owned enterprises, including NNPCL. Wadada reaffirmed the Senate’s resolve to take appropriate actions if NNPCL fails to comply within the specified period.

Among the financial anomalies under review are trillions of naira listed as receivables that remain unexplained, as well as the absence of supporting documentation for fees related to legal and auditing services. These irregularities were reportedly discovered in the company’s audited financial statements for the years spanning 2017 to 2023.

The development has heightened public scrutiny of NNPCL, which is one of Nigeria’s most critical revenue-generating entities. The company transitioned from a public corporation to a limited liability company in July 2022 under the Petroleum Industry Act, a move that was expected to improve efficiency and transparency in the oil and gas sector. However, the Senate’s current findings suggest that major lapses in financial governance may still persist within the organization.

Critics and civil society organizations have called for a broader forensic audit of NNPCL’s finances, while also urging the Senate to ensure that the accountability process is carried through to its conclusion. There are increasing concerns that the alleged ₦200 trillion shortfall, if not properly addressed, could have significant implications for Nigeria’s already strained fiscal position.

The NNPCL leadership has yet to issue a formal public response to the Senate’s deadline or the specific allegations raised. However, sources within the corporation have suggested that preparations are underway to compile the necessary documentation and explanations in time to meet the July 10 deadline.

Meanwhile, the Senate committee maintains that it will not hesitate to escalate the matter if the response is deemed unsatisfactory or if the deadline is missed. Senator Wadada emphasized that the Senate’s oversight responsibilities are not optional and that all public officials and institutions must adhere strictly to financial accountability standards.

The outcome of this probe is expected to set a significant precedent for how financial irregularities in key government-owned enterprises are addressed. The Nigerian public and stakeholders across the oil and gas sector are watching closely to see whether the Senate will follow through on its warnings and ensure full accountability in the case of the missing ₦200 trillion.